WPP: Promoting fossil fuel bankrollers

The flames of climate breakdown are being fanned by big banks pouring billions into fossil fuels. But often these ‘fossil banks’ are promoted by adverts painting them as family friendly, socially responsible and even green.

With ad and PR firms working to boost trust in banks, public recognition of their role in climate breakdown is kept at bay, staving off stronger regulation.

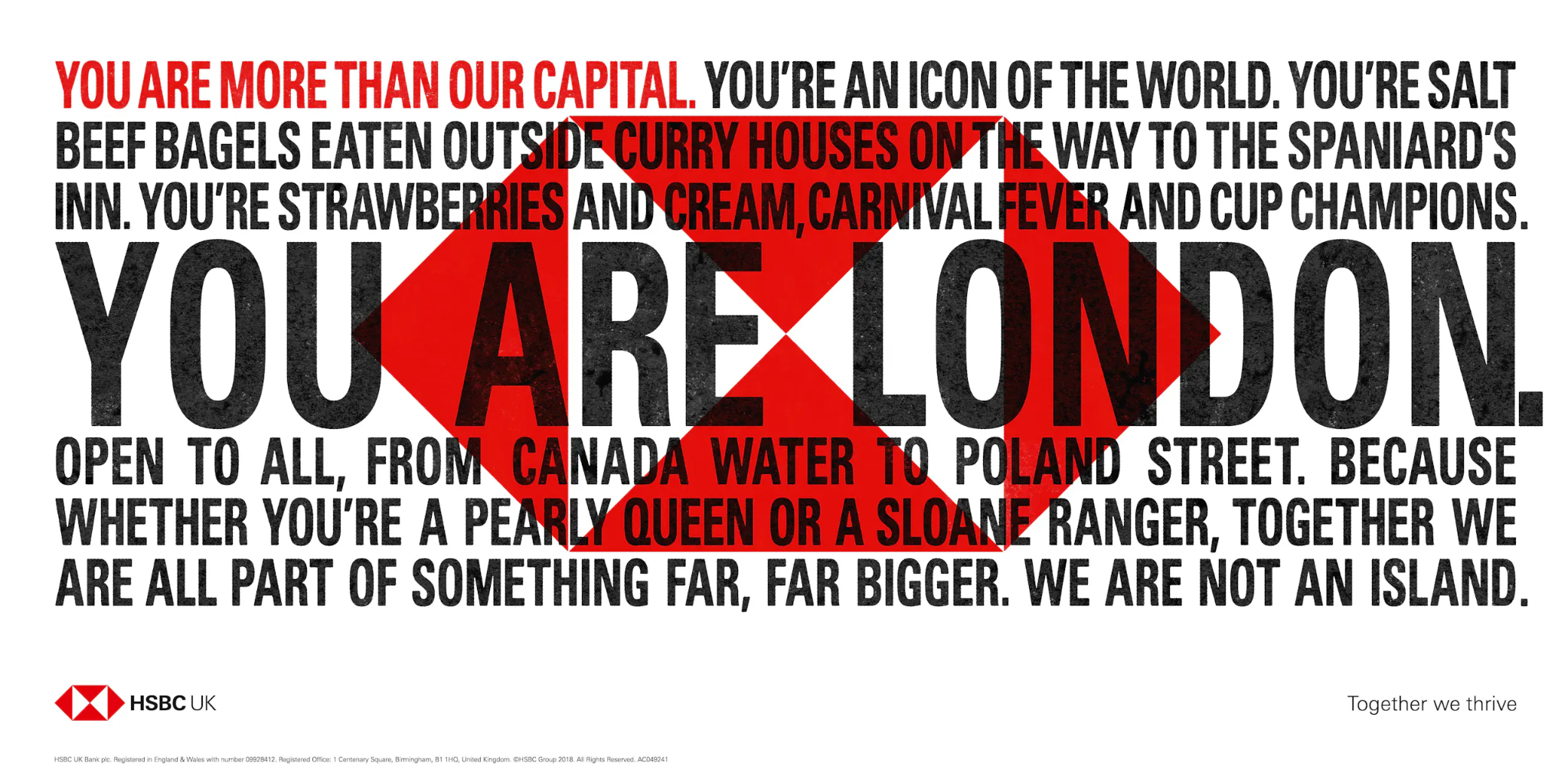

Above: an HSBC advert by WPP agency Wunderman Thompson (now VML). The ad campaign boosted the bank’s ratings: “HSBC saw its number of trades go up about 30% on the back of it.”

WPP, the largest advertising company in the world, works for some of the biggest names in fossil finance. Topping the list of WPP’s polluting bank clients is the world’s worst financier of fossil fuels, JPMorgan Chase.

WPP successfully pitched for JPMC in 2021, a year in which the bank funneled a catastrophic $61.832 billion (£50 billion) into fossil fuels. At the time, 2021 was also the sixth warmest year on record, at a global average temperature that has been repeatedly smashed since.

Since the 2015 Paris Climate Agreement, JP Morgan Chase has poured $430 billion (£346 bn) into coal, oil, and gas, rapidly accelerating the climate crisis. The bank increased its fossil fuel financing from $38.7 billion in 2022 to $40.8 billion in 2023.

WPP’s clients also include fossil banks Natwest, the Bank of America and HSBC, the second biggest funder of fossil fuels in Europe, after Barclays. In 2022, HSBC ads by WPP agency VML (formerly Wunderman Thompson) were banned for misleading consumers by misrepresenting the bank as green. WPP has worked for HSBC for more than 20 years.

“We cannot save a burning planet with a firehose of fossil fuels”

WPP has also worked for insurers that are among the biggest underwriters of fossil fuel projects, including Allianz.

Under international guidelines for corporate responsibility, big businesses including WPP should seek to prevent or mitigate the adverse human rights and environmental impacts it is contributing to through its clients.

In a first of its kind action, Badvertising and Adfree Cities are reporting WPP to the Organisation for Economic Co-operation and Development (OECD) for allegedly breaching these guidelines, including through its work to promote financiers that are bankrolling fossil fuels.

Data on financing of fossil fuels is from the Rainforest Action Network’s report, which analyzes the world’s 60 largest banks by assets according to S&P Global’s annual ranking: Banking on Climate Chaos 2024.

Above: 2024 NatWest “Tomorrow Begins Today” campaign by WPP’s The&Partnership. According to industry outlet The Drum, the campaign aimed “to drive re-appraisal of NatWest, modernising the bank to achieve sustainable growth.” NatWest continues to fund fossil fuels.

JP Morgan Chase

WPP successfully pitched for JPMC in 2021, a year in which the bank funneled $61.8 billion (£50 billion) into fossil fuels.

JP Morgan Chase bank has poured $430 billion (£346 bn) into coal, oil, and gas since 2015, rapidly accelerating the climate crisis. JPMC isn’t winding down; in 2023, the bank increased its fossil fuel financing by almost $2 billion from $38.7 billion in 2022 to $40.8 billion in 2023.

In 2023, the UN warned JPMorgan that the bank is playing a role in human rights violations driven by climate breakdown, through its financing of fossil fuel giant Saudi Aramco.

JPMorgan Chase is also the world’s biggest financial backer of fossil fuel expansion, increasing their financial commitments to fossil fuel companies with expansion plans from $17.1 billion in 2022 to $19.3 in 2023. The bank has exited the Net-Zero Banking Alliance, which aimed to align financing with a goal of reaching net-zero greenhouse gases by 2050.

Much of WPP’s work for JPMorgan Chase is behind paywalls and NDAs. Regardless, WPP’s offer is to help clients “to innovate, transform and grow.” Growing JPMorgan Chase means growing fossil fuel expansion. And WPP has demonstrably failed to ‘transform’ JPMC to become more sustainable, if this was ever their intention.

WPP’s agency team GroupM, which includes Mindshare, Wavemaker, EssenceMediaCom and m/Six, is responsible for the JPMC account. EssenceMediaCom ran the media planning and buying for JPMC’s 2024 ad, “see what your money can do”, helping to grow JPMC’s brand in the UK.

Also in 2024, EssenceMediaCom won an award for its work with media partner Forbes promoting JPMorgan Chase’s “Women on the Move” initiative, linking the bank with gender equality. Studies have repeatedly found that the impacts of climate breakdown, worsened by JPMC’s fossil fuel financing, will disproportionately impact women including through pregnancy complications, greater vulnerability to extreme weather events and domestic violence, as well as amplifying existing gender inequalities.

Bank of America

WPP’s BCW (Burson Cohn & Wolfe, now Burson) won an award for its consumer facing “Better Money Habits” PR campaign for Bank of America (BofA) in 2024. The PR firm has worked with BofA since at least 2013, including seemingly driving the bank’s PR efforts to award $50,000 to not for profits in California, a US state devastated by wildfires and extreme weather driven by climate breakdown.

Bank of America is the third biggest financial backer of fossil fuels in the world, after JPMorgan Chase and Citi. From 2016-2023, BofA has poured an unthinkable $333 billion into fossil fuel companies that are worsening global heating and harming the health of communities across the world.

Bank of America ranked joint fourth worst in the world for backing fossil fuel expansion in 2023, pouring $14.7 billion into companies expanding their fossil fuel operations. BofA has rolled back previous commitments to end its support to fracking, which damages the health of local communities and releases harmful greenhouse gases. The bank has also exited the Net-Zero Banking Alliance. WPP, however, seemingly still works to promote and manage the reputation of the Bank of America.

HSBC

In 2022, HSBC launched their “climate change doesn’t do borders” ad campaign, fronted by Richard Ayoade, by WPP’s agency Wunderman Thompson (now VML). The ads championed HSBC’s sustainability efforts, such as planting 2 million trees in the UK.

But HSBC is Europe’s second largest funder of fossil fuels, after Barclays. Between 2016 and 2021, HSBC poured £115 billion into oil and gas companies around the world, including Saudi Aramco, ExxonMobil and Shell.

The “borders” ads were banned by the UK ad regulator in 2022 for making false green claims, but HSBC’s contribution to the climate crisis doesn’t stop there. The bank finances deforestation and is the 6th largest global lender to the plastic supply chain, facilitating a mountain of plastic pollution responsible for catastrophic damage to oceans and global ecosystems.

HSBC has not only poured more than $192 billion into fossil fuels between 2016 to 2023. A series of cutting investigations by The Bureau of Investigative Journalism has found that HSBC’s “Sustainable Finance” is really paying for coal mines, pipelines and oil rigs, while in the two years after HSBC pledged to stop financing new oil and gas fields, the bank helped raise more than $47bn (£37bn) for companies that are expanding production of oil and gas.

See our FAQs to discover more about our OECD complaint against WPP. Please get in touch if you’d like more information.